Written by Shaweta Sharma

Edited by Himanshi Shivani

The Indian banking system has become much aware since the Nirav Modi and Mallya bank frauds have occurred. But this awareness is not resulting in a decrease in bank frauds.

Although the discovered bank fraud cases in a financial year don’t occur that year still the number shows the weakness of the Early Warning System and slow execution of the banking system.

Reasons for Bank Frauds in India

As mentioned above the implementation and slow working process is the main reason for increasing bank frauds that infect the monetary function of the economy. Some main reasons are:

1. Non-detection of EWS during an internal audit

2. During the forensic audit, borrowers don’t cooperate

3. Joint lender meetings don’t lead to proper decisions

4. Audit reports are inadequate

5. No praise for the loyalty of officers

6. Grouping of bankers and fraudsters

Present Situation

The biggest bank fraud of 2020 so far has been the Yes Bank scam. In March, CBI registered two cases against Rana Kapoor and his family members.

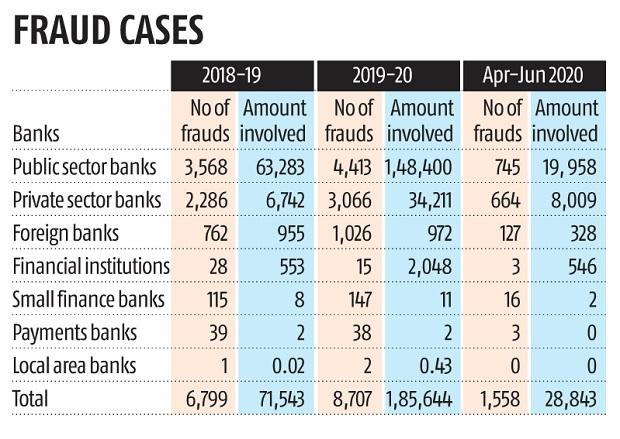

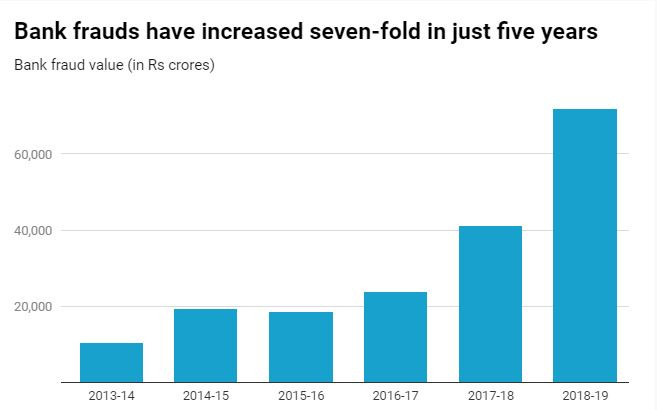

According to the RBI’s annual report for 2019-20 Bank frauds worth more than Rs 1.85 lakh crore were reported in the year ended June 2020 compared with over Rs 71,500 crore in 2018-19.

The major concern is large value frauds in this report as the top 50 credit-related frauds containing 76% of the total amount reported as frauds.

Over the last couple of years, the trend shows more than half of frauds are happening in the Public sector. These banks accounted for 80% of the total such scams while Private Banks reported over 18% of the total fraud cases.

The annual report of RBI states in the case of large frauds, where the amount is more than Rs 100 crore, the average lag was 63 months between the date of occurrence of fraud and its detection by the bank or financial institution. On the other hand, this lag is 24 months in cases with an amount below Rs 100 cr.

Indian banking and finance systems really need to focus on their lending system because 98% percent of all frauds happen in this phase.

These frauds are the result of our weak financial system and lack of technology in banks that need to recover for the better and growing GDP.

0 Comments